I consider myself well above average in understanding money, the economy, and the different concepts that orbit these two forces of human life. However, I still find myself struggling to discuss it or explain it in a simple way.

This means, cleary, I don’t understand it well enough. And if I’m correct about being well above average in this department, that means the average person is severely lacking in knowledge in this arena.

And since I think understanding these concepts are vitally important for anyone playing the game of life, I thought it prudent to create a series on just that.

So from here on out, Mondays are dedicated to writing about the workings of the economy and how individuals fit within the system.

Getting an overview of the machine known as the economy seems like as good a place to start as any. Everything written in this post comes from a 30-minute video put out by Ray Dalio called, How The Economic Machine Works.

I don’t cover the entire video in this post. It will likely take 3-4 posts just to cover this video.

Without further ado, let’s get started…

The Economy - Main Components

Though the economy seems complex, it works in a simple understandable way.

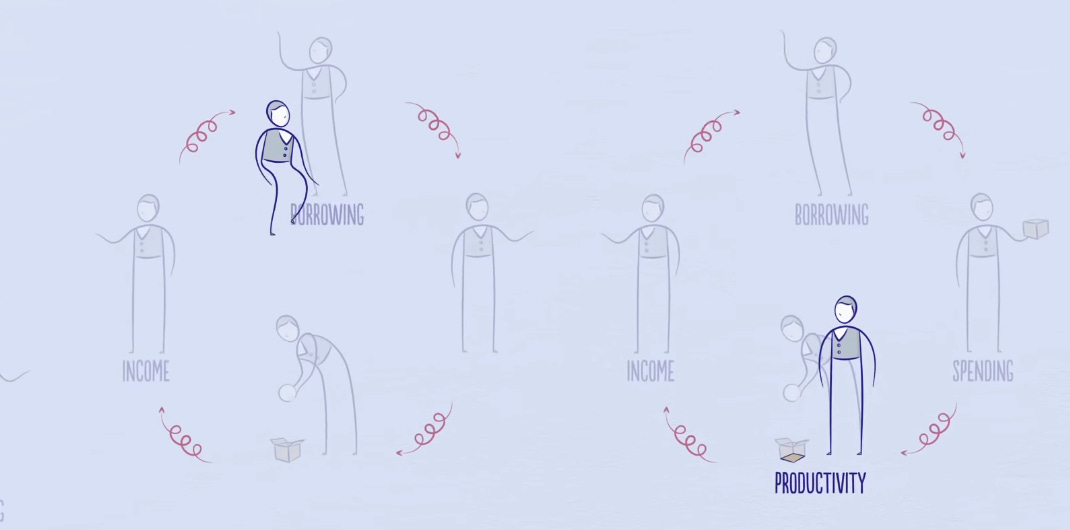

It is driven by three main forces:

Productivity Growth

Short Term Debt Cycle

Long Term Debt Cycle

Laying these on top of each other creates a good template for tracking economic movements and figuring out what’s happening now.

![Archived Post ] How The Economic Machine Works by Ray Dalio Archived Post ] How The Economic Machine Works by Ray Dalio](https://substackcdn.com/image/fetch/$s_!17qL!,w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fbucketeer-e05bbc84-baa3-437e-9518-adb32be77984.s3.amazonaws.com%2Fpublic%2Fimages%2F8ad509c2-b297-4a38-996d-b09d9159f5c9_1136x657.png)

Before getting into the 3 forces, let's first take a look at Transactions.

An economy is simply the sum of the transactions that make it up. Every time you buy something, you create a transaction. Each transaction consists of a buyer, exchanging money or credit, with a seller for goods, services or financial assets.

Credit spends just like money, so adding together the money spent and the amount of credit spent, you can know the total spending, which drives the economy.

All forces within the economy are driven by transactions, so if we can understand transactions, we can understand the whole economy.

A market consists of all the buyers and all the sellers making transactions for the same thing. For example, there is a wheat market, car market, housing market, etc.

The economy consists of all of the transactions in all of its markets. If you add up the total spending and total quantity sold in all of the markets, you have everything you need to know to understand the economy.

The main players in the economy are:

People

Businesses

Banks

Governments

The biggest buyer and seller is The Government, which consists of two important parts.

Central Government - collects taxes and spends money

Central Bank - controls the amount of money and credit in the economy.

This is done by influencing interest rates and printing money.

For these reasons, the central bank is an important player in the flow of credit.

Credit is the most important part of the economy, and probably the least understood. Why is it the most important part? Because it is the biggest and most volatile.

Let's dive into the credit market to better understand.

Lenders typically want to make their money into more money, and borrowers usually want to buy something they can't afford. Or possibly to invest in something, like starting a business.

When interest rates are high, there is less borrowing because it is too expensive. When interest rates are low, borrowing increases because it's cheaper. When borrowers agree to repay, and lenders believe them, credit is created.

One thing that makes credit tricky is that it has different names. For instance, once credit is created it immediately turns into debt. Debt is both an asset to the lender and a liability to the borrower. Once the debt is repaid, the asset and liability disappear and the transaction is settled.

This brings us to the biggest lesson so far:

When a borrower receives credit he is able to increase his spending. And spending drives the economy. This is because one person's spending is another person's income.

When someone's income rises, it makes lenders more willing to lend him money, because now he is more worthy of credit.

What makes someone creditworthy?

The ability to repay

Collateral if he can't

In simple terms, it works like this...

The boost to income provides a boost to borrowing. The boost in borrowing provides a boost to spending. The boost in spending provides a boost in productivity. The boost in productivity provides a boost to income. So on and so forth.

And since one person's spending is another person's income, it creates an environment for growth.

It is this process that leads to cycles, which we'll dive into next week.